With heavy hitters like AT&T, T-Mobile and Verizon, the Isis mobile payment initiative had the potential to bring mobile payments to the masses while also creating a strong competitor to Visa and MasterCard. The Isis venture shifted strategy to include the payment giants recently and AT&T indicated that federal regulations had a lot to do with it.

“Some changes in the banking laws occurred with the amendments that were put in with the Dodd-Frank bill … As transaction fees were limited and things were changed, it kind of changed the business model,” said AT&T’s John Stankey, according to Reuters.

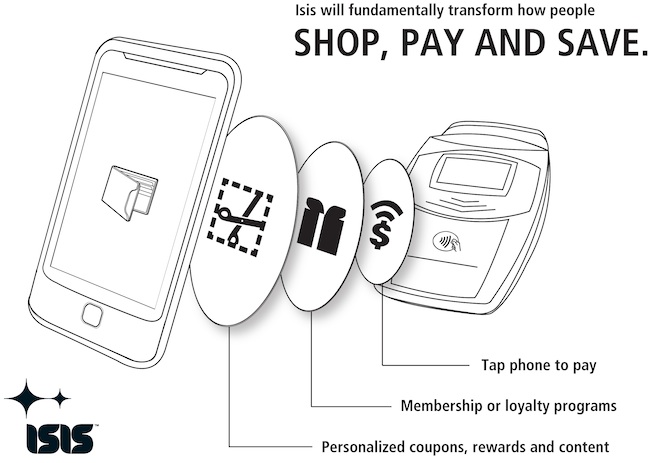

The Isis venture had originally partnered with Discover to build out this mobile payment system which would be based on NFC. Basically, it would have brought the tap-to-pay system that’s live in Japan to the United States. The problem is that Discover doesn’t have the same clout as Visa or MasterCard and it isn’t accepted in as many places.

Isis is live in a test market but the big push will center around creating a mobile digital wallet where users can integrate their existing Visa or MasterCard credit and debit cards. It’s unclear what role Discover will now play, Reuters says.

There are a few ways to look at this, as I’m sure some will say that the governmental regulations are killing innovation in the mobile payment space. I’ve heard many times that the money space is one that’ ripe for innovation and restrictive regulations may make it more difficult for this to happen.

The other side is that it should be a highly-regulated space because this is people’s money. If your Facebook app crashes, it’s a pain in the you-know-what but it’s a minor annoyance. If a money app crashed and actually meant you lost real cash, that would be quite the disaster.

[Via Reuters]