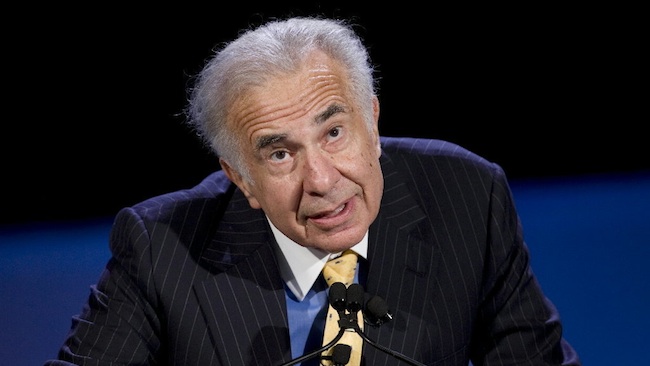

Carl Icahn is a rich old white guy who pours money into companies that he thinks he can turn around. He’s the guy who made Motorola split up, so don’t assume for a second that he’s out of his mind. Now like all investors, Carl knows when to buy and when to sell. According to Reuters, he recently sold his $250 million share of LightSquared. Why? It’s a long story, but here’s what you need to know: LightSquared was born in the summer of 2010. Their goal was to build a high speed LTE-Advanced network that anyone could lease. In other words, they wanted to be an ultra dumb pipe. Originally they wanted Nokia Siemens Networks to build their network, but then they decided to partner with Sprint. While all this is going on, government officials start asking LightSquared for proof that their network isn’t going to break GPS. Why would their network do that? Because the spectrum that LightSquared owns sits incredibly close to the spectrum that GPS uses. Several rounds of testing proved that no matter what the company did, they couldn’t prevent interference. The FCC basically told LightSquared to pack their bags and go home.

So back to Carl. He invested in LightSquared because he thought that the company could make some dough off their key asset, spectrum. But now that the FCC has said that said spectrum is useless, it’s time to bail. Did Carl lose money? According to that Reuters report, no. He bought some LightSquared debt at $0.40 on the dollar and sold it for around $0.60. That’s a 50% return on investment for doing nothing but moving paper around. Makes you think why you’re doing exactly what it is you’re doing, doesn’t it?

The FCC hates LightSquared, Carl Ichan hates LightSquared, so we’d like to make a proposal: Let us never talk about LightSquared ever again. Pretty please.